Guides

Step-by-step how-to guides for Canadian investors and savers.

Step-by-step guide to visualizing your debt-free journey. Learn how to enter debts, compare strategies, and understand your payoff date.

Est. time: 5-10 minutes

Step-by-step guide to transferring your investment accounts between brokerages in Canada. Learn about ATON transfers, fees, and timelines.

Est. time: 2-3 weeks

Strategies and tips for getting the most value from brokerage promotions. Learn about multi-account bonuses, timing, and optimization.

Complete guide to Questrade's current promotion, including how to qualify, account types, rates, and tips for maximizing your reward.

Everything you need to know about Wealthsimple's transfer bonus offers, reward options, and how to choose the best rate for your situation.

Understanding how brokerage bonuses are taxed in Canada. Learn about tax treatment for registered and non-registered accounts.

Learn when to transfer your accounts to maximize rewards while minimizing fees and tax implications.

How to transfer your RRSP between institutions without tax consequences. Step-by-step instructions and important considerations.

Learn how to accurately calculate your term life insurance needs using the DIME method. Step-by-step instructions for our interactive tool.

Est. time: 5-10 minutes

Step-by-step guide to the RRSP Loan Calculator: what each field means, how to interpret results, and when an RRSP loan makes sense. Learn the gross-up strategy and best practices.

Est. time: 1-2 hours to plan, 5-10 business days for loan approval

Step-by-step guide to each field in the TFSA room calculator. Learn what birth year, residency year, contributions, and withdrawals mean and how to avoid over-contribution.

Est. time: 5–10 minutes

Step-by-step guide to the RRSP room calculator. Learn what earned income, pension adjustment, carry-forward, and province mean and how to interpret your refund estimate.

Est. time: 5–10 minutes

Step-by-step guide to the FHSA room calculator. Learn how annual limit, carry-forward, and lifetime limit work and how to use the tool whether you have an FHSA or not.

Est. time: 5–10 minutes

Step-by-step guide to comparing RRSP, TFSA, and non-registered accounts. Learn what each field means and how to interpret your results.

Est. time: 5–10 minutes

Step-by-step guide to the Dividend Tax Credit Calculator. Learn what province, annual income, and investment amount mean and how to interpret eligible vs non-eligible dividends and interest.

Est. time: 5–10 minutes

Step-by-step guide to estimating capital gains tax. Learn what proceeds, ACB, expenses, and province mean and how to interpret your results.

Est. time: 5–10 minutes

Step-by-step guide to our ultimate mortgage comparison engine. Compare up to 4 strategies side-by-side, model variable rate changes, and share expireable links with your broker.

Est. time: 5-10 minutes

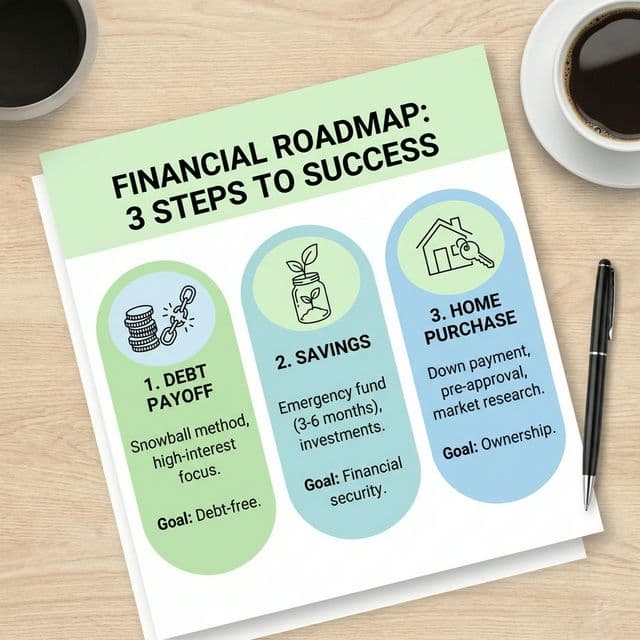

Learn how to use our 3-step chain tool to clear debt, save for a down payment, and calculate your future mortgage and home affordability.

Est. time: 10-15 minutes

Step-by-step guide to calculating your ideal emergency fund target based on your essential monthly expenses and savings capacity.

Est. time: 5-10 minutes

Step-by-step guide to comparing Canadian high-interest savings accounts and finding the best rate for your emergency fund or short-term savings.

Est. time: 3-5 minutes