How to Use the Debt-Free Home Buyer Plan

Learn how to use our 3-step chain tool to clear debt, save for a down payment, and calculate your future mortgage and home affordability.

Estimated time: 10-15 minutes

AI Generated by TrackMoola

List Your Debts

Start by gathering all high-interest debt (credit cards, personal loans, car loans). You'll need the current balance, interest rate, and your monthly payment for each.

Set Your Target Home Price

Decide on a realistic price for your first home. If you're unsure, check recent listings in your preferred city. The tool defaults to a 20% down payment plan.

Launch the AI Analysis

Open the TrackMoola Chat and ask for a 'Debt-Free Home Buyer Plan'. Provide your debt details and home goal. The AI will orchestrate the transition for you.

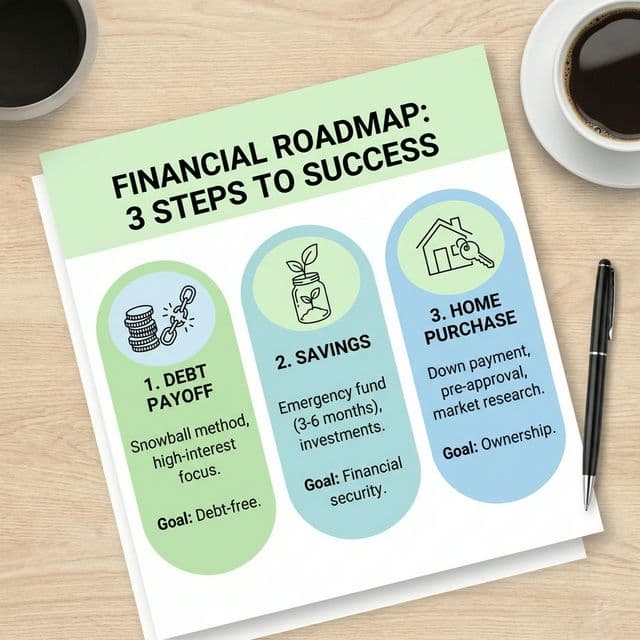

Review the Debt Payoff (Step 1)

See how many months it will take to be debt-free. This phase focus on clearing liabilities to free up monthly cash flow for your home savings.

Analyze the Savings Phase (Step 2)

Observe how the cash previously used for debt is now redirected to your down payment. The tool calculates the exact month you'll hit your target.

Calibrate the Mortgage (Step 3)

Finally, see your future mortgage payment. Since you're debt-free, you'll have higher affordability and lower stress when you move in.

Explore the Full Timeline

Use the Summary section to see the 'Total Years to Homeownership'. You can tweak your home price or savings rate to shorten this timeline.