Blog

Latest articles on Canadian brokerage promotions, tax planning, and personal finance.

Sarah felt like her debt balance never moved. See how switching from 'random payments' to the Avalanche method changed everything.

February 12, 2026

Looking for the best brokerage promotion in Canada? We've compared all current offers to help you find the highest rewards for your accounts.

January 15, 2026

Transferring your RRSP between brokerages can help you take advantage of promotional bonuses. Here's everything you need to know.

January 10, 2026

We compare the current promotions from three major Canadian brokerages to help you decide which offer is best for you.

January 5, 2026

Brokerage transfer bonuses can be confusing. This comprehensive guide explains everything you need to know.

December 28, 2025

Brokerage bonuses are generally taxable in Canada. Here's what you need to know about reporting them on your tax return.

December 20, 2025

Looking to transfer your TFSA? Here are the best brokerage promotions specifically for Tax-Free Savings Accounts.

December 15, 2025

Timing matters when switching brokerages. Here's when to make the move to maximize your rewards.

December 10, 2025

Is term insurance a waste of money? How much do you really need? We dive into the most popular Reddit and Twitter debates about life insurance.

January 31, 2026

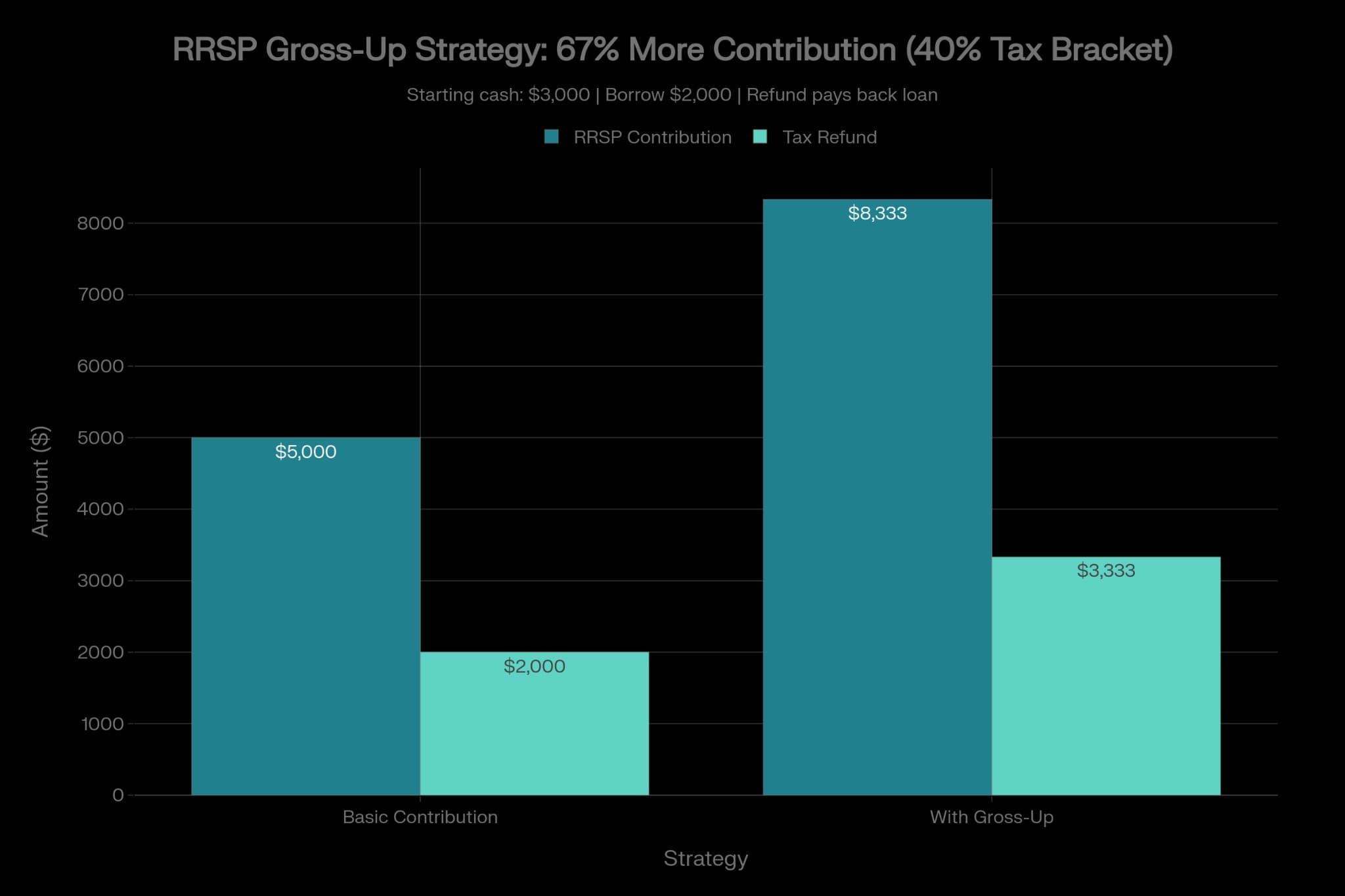

With the March 2, 2026 RRSP deadline approaching, many Canadians wonder: should I borrow to maximize my contribution? Learn when RRSP loans work—and when they don't.

February 7, 2026

I had $10,000 to invest but didn't know whether to put it in my RRSP, TFSA, or a non-registered account. Here's how the Account Type Comparison calculator gave me a clear answer—and the exact numbers behind it.

February 10, 2026

I was about to contribute $7,000 to my TFSA in 2026 when I decided to double-check my room. Here's how the TFSA Room Calculator showed I had already used part of my limit—and saved me from a costly mistake.

February 10, 2026

With the RRSP deadline approaching, I wasn't sure how much room I had or what my refund might be if I contributed $10,000. The RRSP Room Calculator gave me both numbers in seconds.

February 10, 2026

I opened an FHSA in 2024 but hadn't contributed the full $8,000 each year. When I got serious about buying in 2026, I used the FHSA Room Calculator to see how much I could still contribute and what my remaining lifetime room was.

February 10, 2026

I had $20,000 in a non-registered account and couldn't decide between dividend-paying Canadian stocks and a GIC. The Dividend Tax Credit Calculator showed me exactly how much I'd keep after tax in each scenario.

February 10, 2026

I was selling a rental property and wanted to know how much tax I'd owe. The Capital Gains Tax Calculator gave me an estimate in minutes using my province, income, proceeds, and ACB.

February 10, 2026

Choosing the right mortgage strategy can save you tens of thousands of dollars. With our new comparison engine, you can now model every scenario from rate changes to recurring prepayments.

February 14, 2026

Marcus felt stuck with credit card debt and a dream of homeownership. Here is how he used our chain calculator to build a realistic 4-year roadmap.

February 12, 2026

Priya had $200 in her savings account and a nagging fear of 'what if.' Here's how she turned that anxiety into a $12,000 safety net in under a year.

February 13, 2026

Earning 0.05% in a big bank savings account? You're leaving hundreds of dollars on the table. Here are the best alternatives for 2026.

February 13, 2026