Should You Take an RRSP Loan? A Complete Guide with Real Scenarios

By TrackMoola Team · February 7, 2026

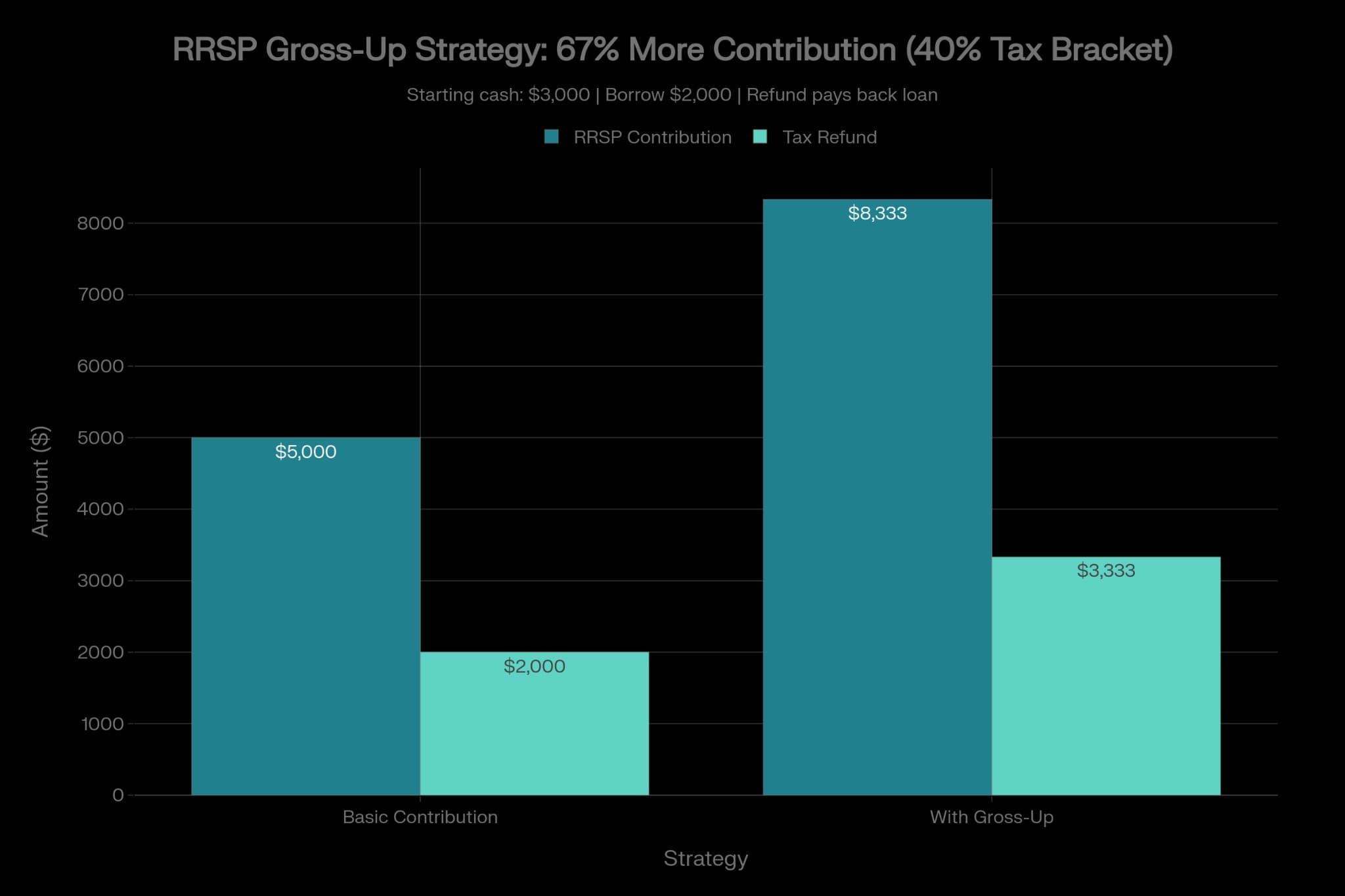

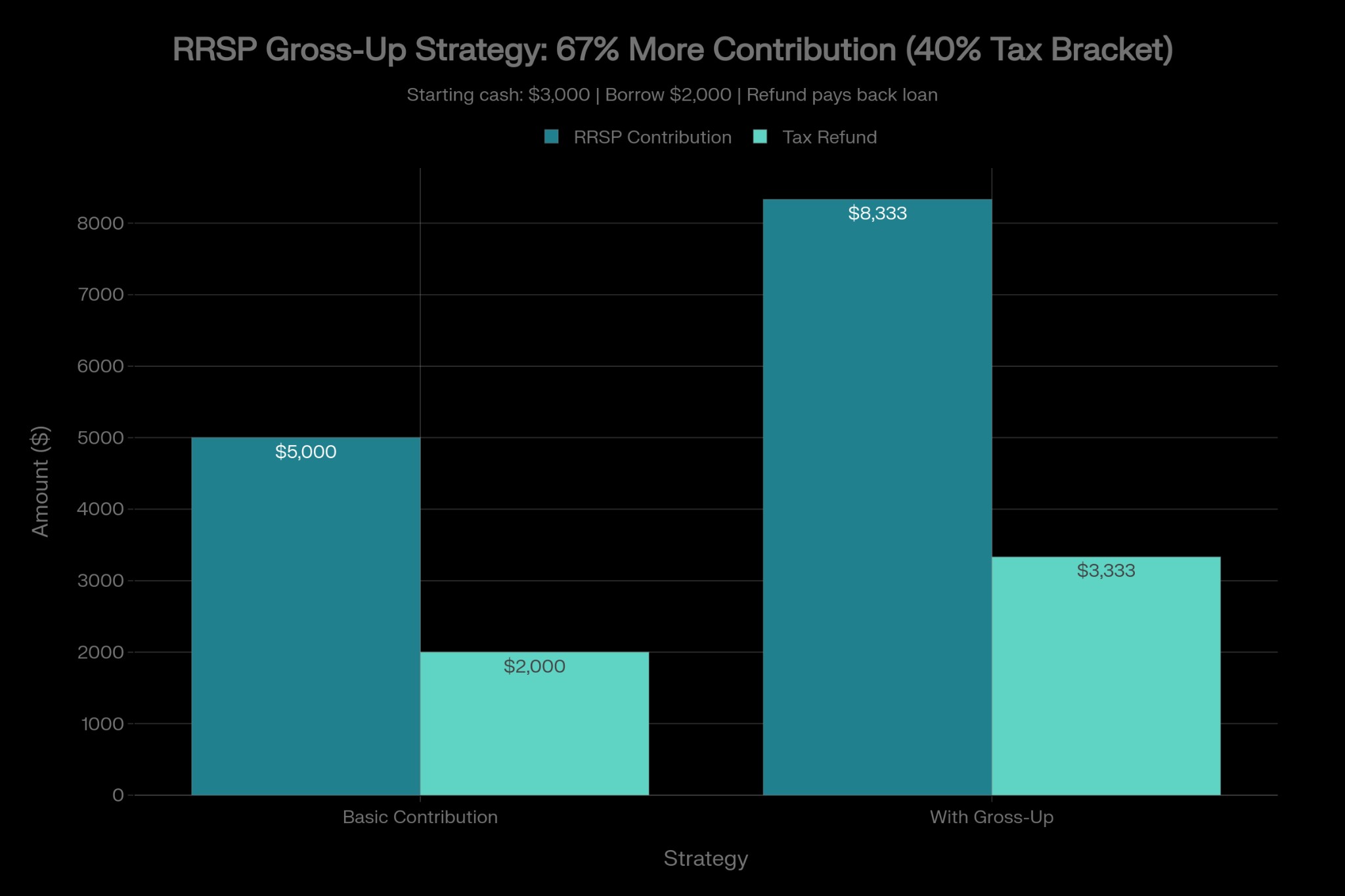

Chart by TrackMoola

It's RRSP season, and with the March 2, 2026 deadline approaching, many Canadians are wondering: should I borrow to maximize my contribution?

The answer isn't one-size-fits-all. An RRSP loan can be a powerful wealth-building tool for some—and a costly mistake for others. In this guide, we'll walk through real scenarios, show you exactly when RRSP loans make sense, and introduce our RRSP Loan Decision Calculator to help you make the right choice for your situation.

What Is an RRSP Loan?

An RRSP loan is a personal loan specifically designed to fund your Registered Retirement Savings Plan contribution. Since RRSP contributions reduce your taxable income, the loan helps you get an immediate tax deduction, invest more money earlier, and use your tax refund to pay down the loan. Most Canadian financial institutions offer RRSP loans with terms from 1 to 10 years, typically at rates around prime.

The Key Question: Does the Math Work for You?

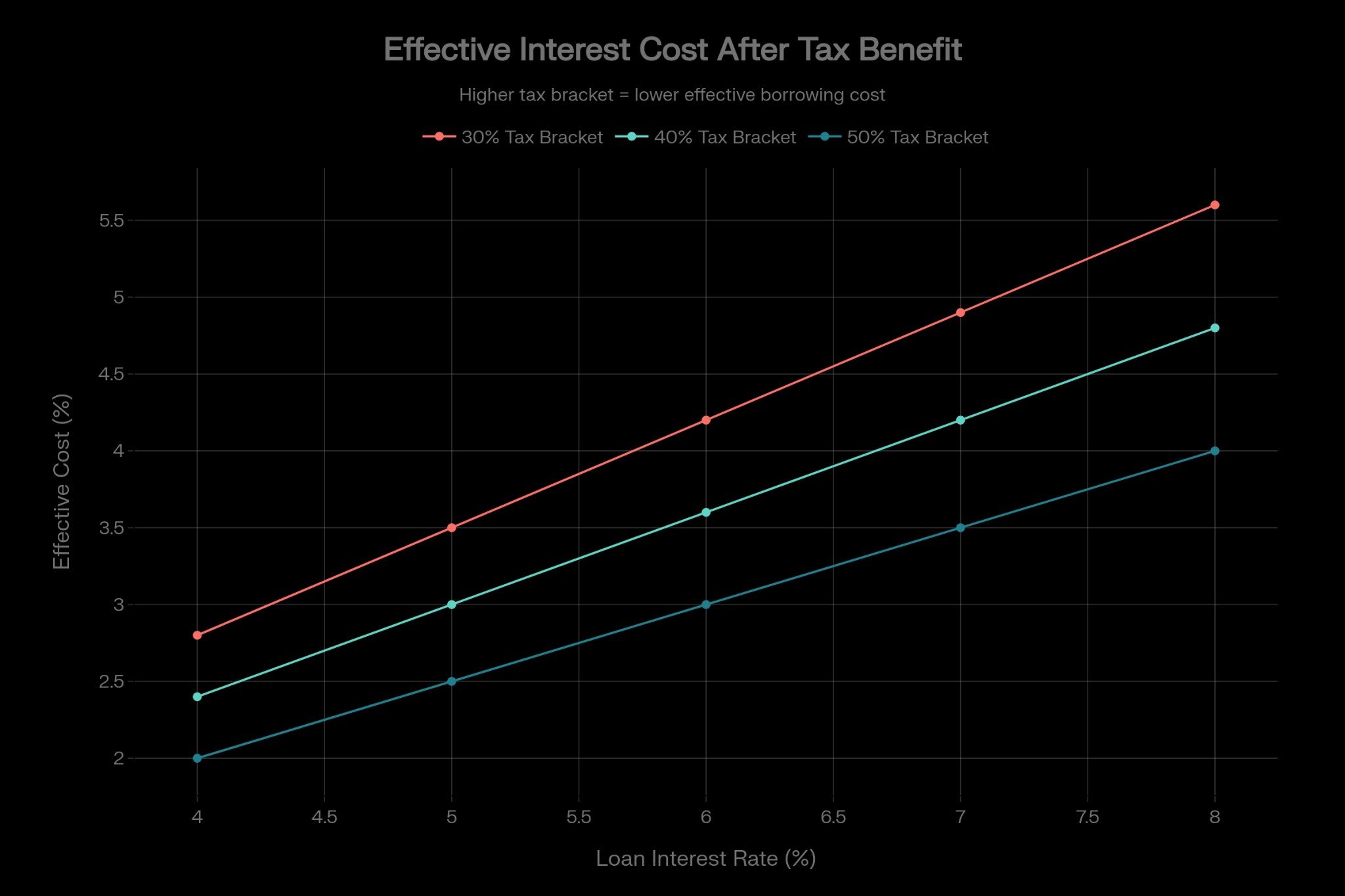

The success of an RRSP loan strategy depends on three critical factors: your marginal tax rate, the loan interest rate, and your ability to repay. Let's look at three real scenarios using a $10,000 RRSP loan at 5.5% interest over 12 months.

Scenario 1: Sarah – High Income ($120,000/year) – Good fit

Sarah's combined marginal tax rate in Ontario is 43.41%. Her tax refund on a $10,000 contribution is $4,341. She uses her refund to immediately pay down 43% of her loan. Her effective borrowing cost is only about 3.1%. If her RRSP investments earn more than 3.1%, she comes out ahead. Verdict: RRSP loan makes sense.

Scenario 2: Mike – Medium Income ($75,000/year) – Moderate fit

Mike's marginal tax rate is 29.65%. His refund covers less of the loan. He might be better off contributing monthly or doing a smaller gross-up loan to supplement his existing savings. Verdict: Consider alternatives.

Scenario 3: Emma – Lower Income with Credit Card Debt – Not recommended

Emma has a 20.05% marginal rate and credit card debt at 19.99%. Adding an RRSP loan would hurt her finances. She should pay down high-interest debt first and consider small monthly RRSP contributions or a TFSA. Verdict: Don't take an RRSP loan.

The RRSP Gross-Up Strategy

For those who already expect a tax refund, the gross-up strategy can dramatically increase your RRSP contribution. Instead of investing your refund after you receive it, you borrow the gross-up amount before the deadline and use the larger refund to pay back the loan. Formula: Gross-up amount = Cash available ÷ (1 - Marginal tax rate). Example: with $5,000 cash and a 40% tax rate, optimal contribution = $5,000 ÷ 0.60 = $8,333. You contribute 67% more using the same after-tax dollars.

When RRSP Loans Make Sense

- You're in a high tax bracket (above ~$90,000 income in most provinces)

- You can pay off the loan within 12 months, ideally using your tax refund

- You have no high-interest debt

- Your employment is stable

When to Avoid RRSP Loans

- You're in a lower tax bracket (under ~$80,000 income)

- You have high-interest debt—pay that off first

- You'd need more than 12 months to repay

- You can't commit to using your tax refund for the loan

How I Used the RRSP Loan Calculator to Decide

I had about $8,000 saved and $22,000 in RRSP room. I was in Ontario earning around $95,000 and wondered if borrowing another $7,000 to max out my contribution before the deadline was worth it. I used TrackMoola's RRSP Loan Calculator and entered my province, income, contribution room, saved amount, and a $7,000 loan at 6% over 12 months. I had no high-interest debt.

The calculator showed my marginal tax rate, my estimated refund on the total $15,000 contribution, and the interest cost over the year. It also showed the gross-up strategy: if I borrowed a bit more (the suggested amount), I could contribute more and use the larger refund to pay off the loan in 2–3 months, cutting interest. I compared the net benefit with and without the gross-up and decided to take a smaller loan and use the refund to pay it off quickly. The tool didn't tell me what to do—it gave me the numbers so I could choose. I followed the How to Use an RRSP Loan Effectively guide to double-check each field.

2025/2026 RRSP Quick Facts

Contribution deadline: March 2, 2026. Maximum contribution: $32,490 (or 18% of 2024 earned income). Typical RRSP loan rates: 5.45% – 6.95%.

Try Our RRSP Loan Decision Calculator

Not sure if an RRSP loan makes sense for you? Our free RRSP Loan Calculator analyzes your specific situation and tells you your expected tax refund, the true after-tax cost of borrowing, and how the gross-up strategy could boost your contribution.

The RRSP contribution deadline for the 2025 tax year is March 2, 2026. Don't wait until the last minute—give yourself time to make an informed decision.

This article is for educational purposes only and does not constitute financial advice. Consult a qualified financial planner for advice tailored to your personal situation.

More to read

RRSP Room Calculator · How I Used the RRSP Room Calculator · RRSP vs TFSA: Account Comparison Story · How to Use an RRSP Loan Effectively